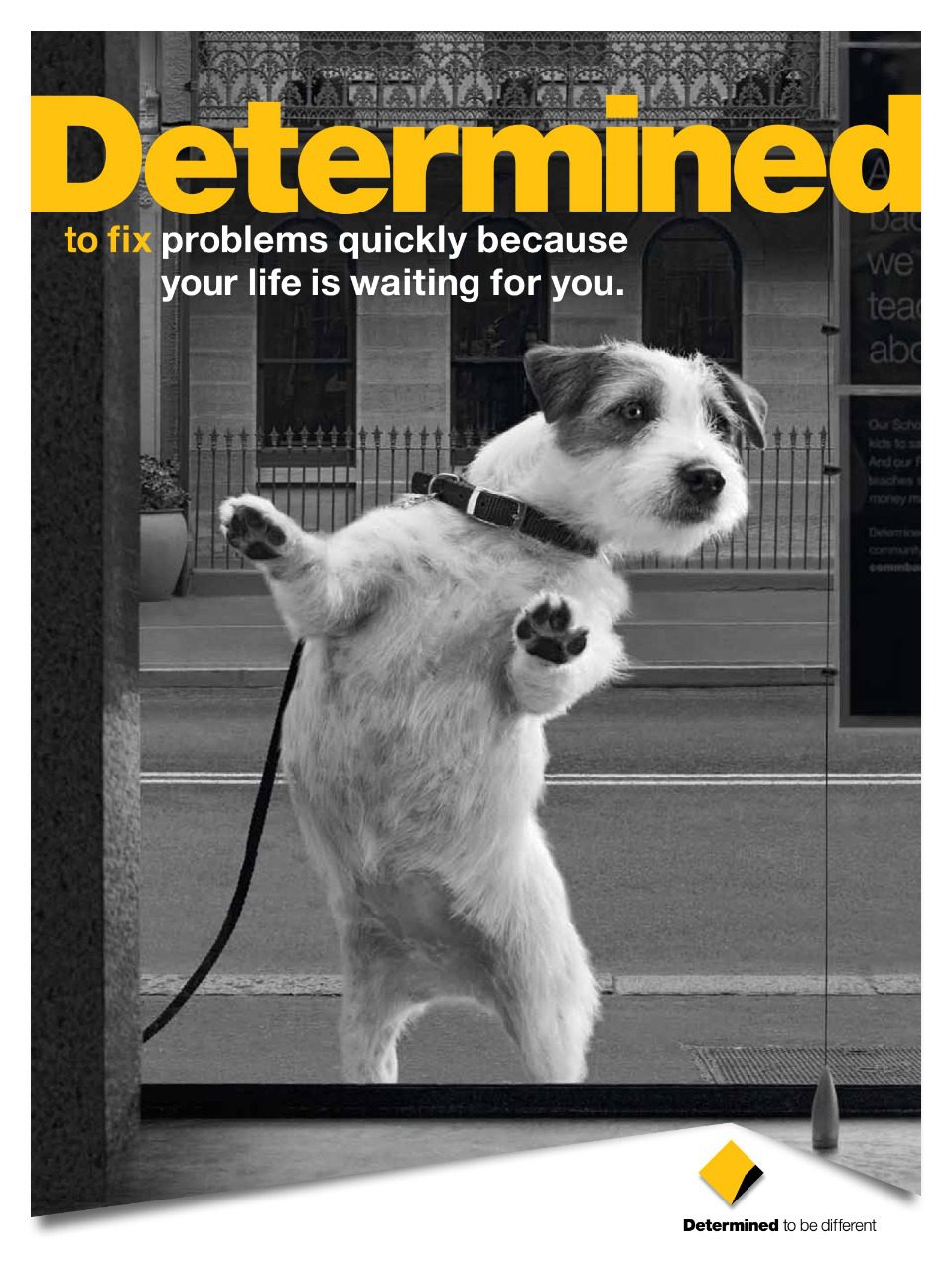

National Australia Bank has bumped up annual earnings to more than $7 billion following a “pleasing” year during which it reaped the rewards of rising interest rates.

Australia largest business bank reported cash earnings of $7.1 billion for fiscal 2022, up 8.3 per cent from the previous year.

Cash earnings are the banking industry’s preferred measure of operational strength because it strips out volatile and one-off items.

NAB’s bottom line net profit also rose 8.3 per cent, to $6.9 billion, in the year ending September 30.

“Our FY22 results are pleasing,” CEO Ross McEwan said on Wednesday.

The result was attributed to volume growth and cost management.

“After 11 years of interest rate reductions, earnings have also benefitted in FY22 from the rising interest rate environment,” Mr McEwan added.

Borrowing rates have been rising steadily since May when the central bank first began hiking the cash interest rate from a historical low of 0.1 per cent.

Mr McEwan pointed to the current economic uncertainty, noting consumers are likely to be challenged by further rate rises and soaring inflation.

“However, strong employment conditions along with substantial household and business savings give us confidence in the resilience of our customers and the broader economy,” he added.

NAb will pay a final dividend of 78 cents, taking the payout for the year to $1.51.

The post NAB posts $7b in earnings after rate rises appeared first on The New Daily.